blog:

The future of Cell & Gene Therapy: Science will take you there (part 1)

In part one of this two-part blog, Bio Sector Lead Joao Incio and Account Manager, Nathan McDine, explore the future expectations and evolving landscape of the cell and gene therapy sector through eight key trends from interviews with 30 biotechnology companies. They explore trends identified by a range of companies across the life science space and delve into their perspectives on recent regulatory, ESG, and funding challenges.

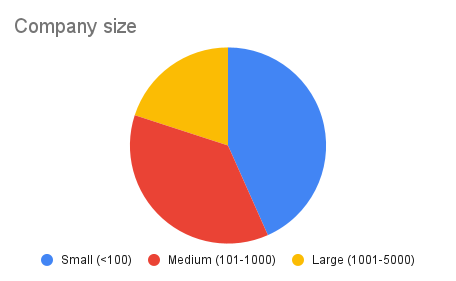

C> biotechnology companies included in this analysis were split by size into three categories:

- Small (1-100 employees)

- Mid (101-1000 employees)

- Large (1001-5000 employees)

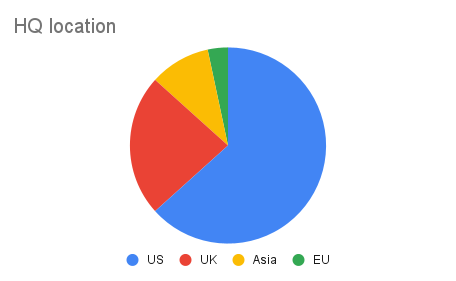

The vast majority of the analyzed companies were small and mid-sized (c.80%). The average and median number of employees were 709 and 153, respectively, ranging from very early-stage startups with six employees to more established biotechs with close to 5000 personnel. 47% of the companies were private and founded between 2006 and 2021. The latest financing rounds for these private companies ranged from early-stage funding of $1.6M to Series B/C of $300M (c.$73M median value). The other half of the companies were publicly traded with market caps from $18M up to $25B, typically with a longer history (since 1989). Company headquarters were predominantly based in the US (66%), followed by the UK (23%).

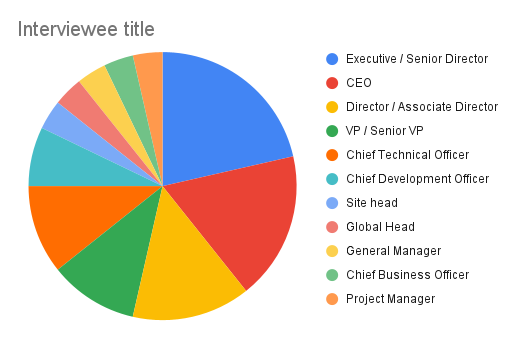

Most interviewees occupied senior roles at their companies, with C-suite executives accounting for c.40%, followed by Executive / Senior Directors at 21% each, also including Director/Associate Director (14%) and VP / Senior VP at 11%.

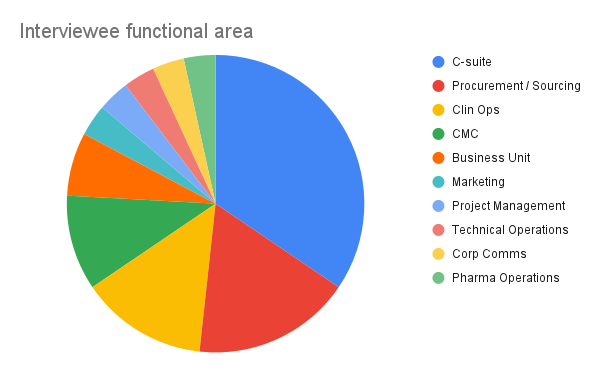

With regards to functional areas of non-C-suite executives, Procurement / Sourcing, Clin ops and CMC dominated.

Key trends in the C>

Approaching C> with a blend of enthusiasm and prudence

The general feeling of interviewed biotech senior leaders is that the field of C> is rapidly evolving and showing great promise for the treatment of various diseases. The advent of groundbreaking advanced therapies marks a significant milestone, profoundly affecting patients grappling with debilitating ailments.

“… there are treatments on the market now where a blind child will be able to see after treatment, or a baby able to walk.”

C-Exec, small biotech, UK

The field of genetic engineering has been revolutionized by gene editing techniques like CRISPR-Cas9, ushering in a new era of possibilities for the treatment of genetic disorders and the development of personalized therapies. Concurrently, CAR-T Cell Therapies have exhibited remarkable achievements in the treatment of specific cancers such as leukemia and lymphoma. Ongoing research is now concentrated on broadening the scope of CAR-T therapies to encompass other cancer types and enhancing their efficacy through optimization efforts.

“…cell therapy certainly is going to grow on the commercial side…all things nucleic seems to be bursting at the seams.”

SVP, small biotech, US

However, interviewed leaders have also shared that the C> field has faced many challenges in recent years, predominantly stemming from safety concerns, setbacks in clinical trials and stringent regulation.

“It’s by no means universally successful, or perfect. The treatments are often very efficacious, but there can be side effects. There’s room for improvement.”

C-Exec, small biotech, UK

“…the percentage [of] clinical holds in C> is much higher than other trials.”

Senior Director Clinical Ops, small biotech, US

Continued growth is anticipated in the adeno-associated virus vector (AAV) gene therapy field

Interviewees perceive the AAV gene therapy sector as holding tremendous promise for disease cures, with substantial growth projected in the future. In fact, they acknowledge that the current demand for AAV manufacturing companies outweighs the available supply.

“[AAV] grew in the past two years massively. So I think that reflects the demands and the potentials that this gene therapy has.”

Associate Director CMC, small biotech, Asia

As expected, the global AAV manufacturing market was estimated to be within the range of $1-2 billion in 2022. Projections indicate that this market is poised for significant growth, with a compound annual growth rate estimated to be around 15-20%.

Within this specific subsector, interviewees emphasized an ongoing transition towards suspension cell-based platforms, departing from adherent cell systems. These suspension cell platforms are recognized for their ability to generate higher yields, aligning with the industry’s drive for enhanced productivity. Furthermore, there is a notable focus on achieving higher potency, indicating a strong emphasis on maximizing the therapeutic efficacy of a treatment.

AAV may enable expansion to unexplored rare and multigenic disorders

Interviewees perceive AAV technology as a versatile platform capable of being tailored to address a multitude of genetic diseases, thus enabling widespread application. With an estimated 300 million individuals living with rare diseases globally, most of which have a genetic origin, AAV technology is poised to play a pivotal role in addressing the needs of these patients.

Regulatory approvals have been granted for several gene therapies, offering newfound hope for patients suffering from previously untreatable conditions. Currently, gene editing primarily targets rare genetic disorders caused by single gene mutations. However, interviews suggest that the field is expected to expand its focus to encompass multifactorial gene mutation disorders, aiming to address more complex diseases. This expansion would include a range of conditions, such as various types of cancer, as well as autoimmune diseases, where the influence of genes is intricate and multifaceted.

“[moving to multifactorial genetic diseases] will allow gene editing to have a bigger impact on the pharma industry in general.”

US Site Head, mid sized Biotech, Asia

“I think there’s a lot of work to be done to address more diseases by […] gene editing technologies.”

Associate Director CMC, small biotech, Asia

However, the potential success of transitioning to multigene complex diseases remains uncertain, and biotech senior leaders maintain a cautious stance regarding this shift.

“Time will tell whether these become mainstream indications for gene therapy, or whether gene therapy tends to be restricted to rare single gene disorders and inherited diseases”.

Associate Director CMC, small biotech, Asia

“Seven thousand genetic disorders [mean that] 100 million people suffer from some very rare [disease]. Some are easy to tackle, some are just not. Two thousand gene-based disorders are addressable, [and] science will take you there in the next 10-15 years.”

CEO, small biotech, US

When developing mRNA, don’t forget the delivery

mRNA lipid nanoparticles (LNPs) have gained significant attention in recent years due to their crucial role in the development and delivery of mRNA-based vaccines, such as the Pfizer-BioNTech and Moderna COVID-19 vaccines. This has led to increased research and investment in improving the design, stability, and efficacy of mRNA LNPs, as well as expanding their applications beyond infectious diseases.

Researchers are focusing on enhancing the formulation of mRNA LNPs to improve their stability, immunogenicity, and delivery efficiency. This includes optimizing the lipid composition, incorporating stabilizing agents, and modifying the surface properties of LNPs to enhance their cellular uptake and intracellular release of mRNA. In addition, scientists are exploring the use of ligands or antibodies attached to the surface of LNPs to facilitate tissue-specific or cell-specific targeting. This could enhance the efficiency of mRNA delivery and minimize off-target effects.

One interviewee stressed the importance of thinking about delivery methods that leverage LNP when entering the mRNA space:

“…mRNA is fairly useless without a delivery mode. I’m seeing a lot of mRNA companies pop up who have no solution for delivery. So, if someone can bring that to the table in a vertically integrated manner, they’re going to be a pretty compelling offer.”

SVP, small biotech, US

Read more about the other key trends in cell and gene therapy in part 2 of our blog series, coming soon…

In the meantime, why not catch up on our latest sector blogs?

Prescription for sustainability: How pharma companies are nailing (or failing) the ESG game

Trends Changing Biopharma: How is small molecule drug development transforming?

Related news, insight and opinion